GST Annual Return Filing

Comprehensive Filing for Complete Compliance

Filing your GST Annual Return is not just a statutory obligation—it's a reflection of your business’s financial accuracy and transparency. At Account Wale, we help you file your annual returns with precision, ensuring full compliance and peace of mind.

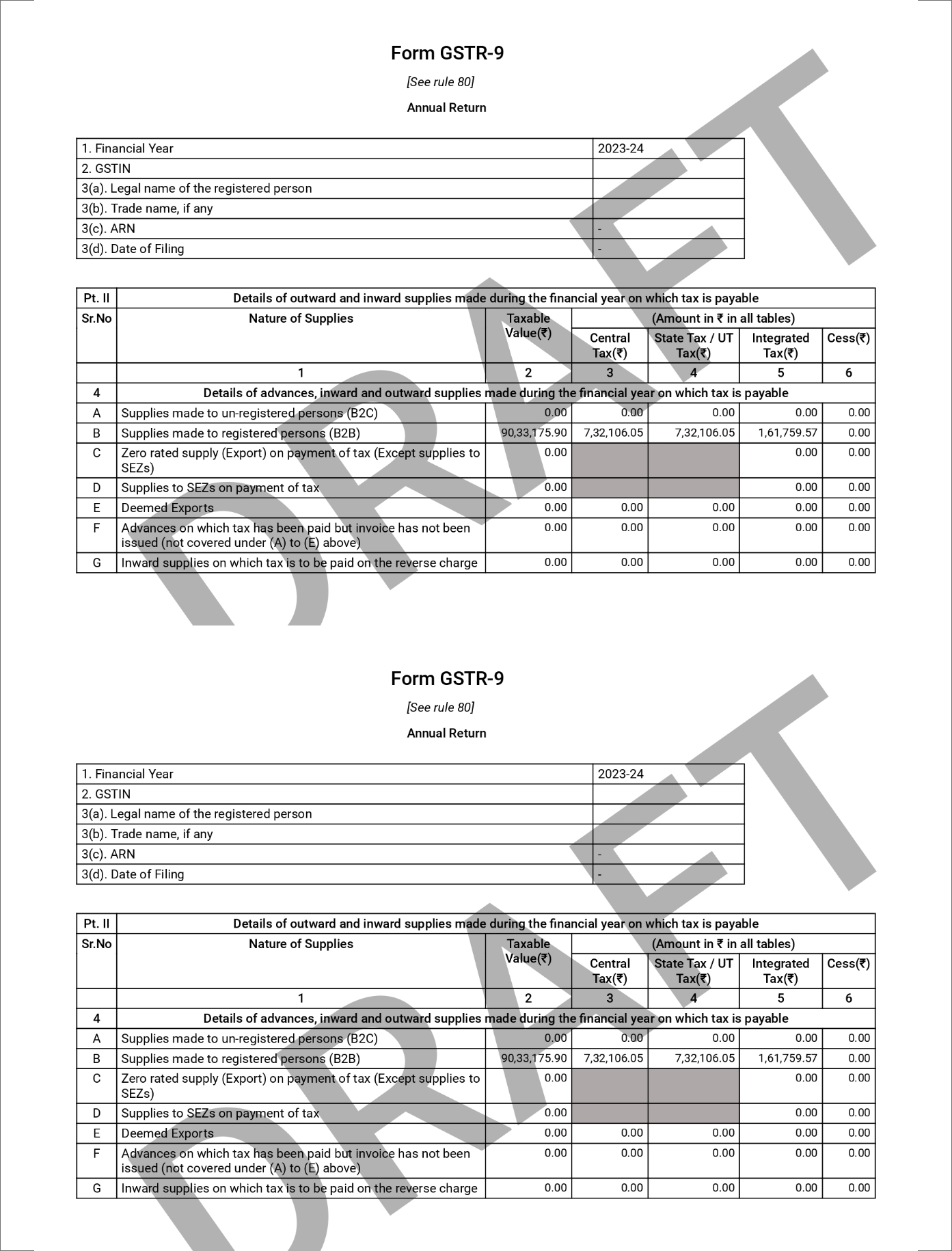

What is GST Annual Return?

The GST Annual Return is a detailed summary of all monthly or quarterly GST returns filed during a financial year. It includes information on outward and inward supplies, taxes paid, input tax credit availed, and adjustments made. Filing is mandatory for all regular taxpayers under GST.

Who Should File?

-

All businesses registered under GST (excluding composition scheme, casual taxable persons, and non-resident taxpayers)

-

Businesses with an annual turnover above ₹2 crores must also file GSTR-9C (reconciliation statement and audit report)

Types of Annual Returns:

Our Services Include: