GST Return Filing

Accurate. Timely. Hassle-Free GST Compliance.

Filing your GST returns correctly and on time is not just a legal obligation—it’s essential for maintaining your business's credibility and avoiding penalties. At Account Wale, we offer expert GST return filing services that ensure you're always compliant and stress-free.

What is GST Return Filing?

GST return filing is the process of submitting the details of your sales, purchases, tax collected, and tax paid to the GST department. Every registered business under GST is required to file returns monthly, quarterly, or annually, depending on the category.

Types of GST Returns We File:

-

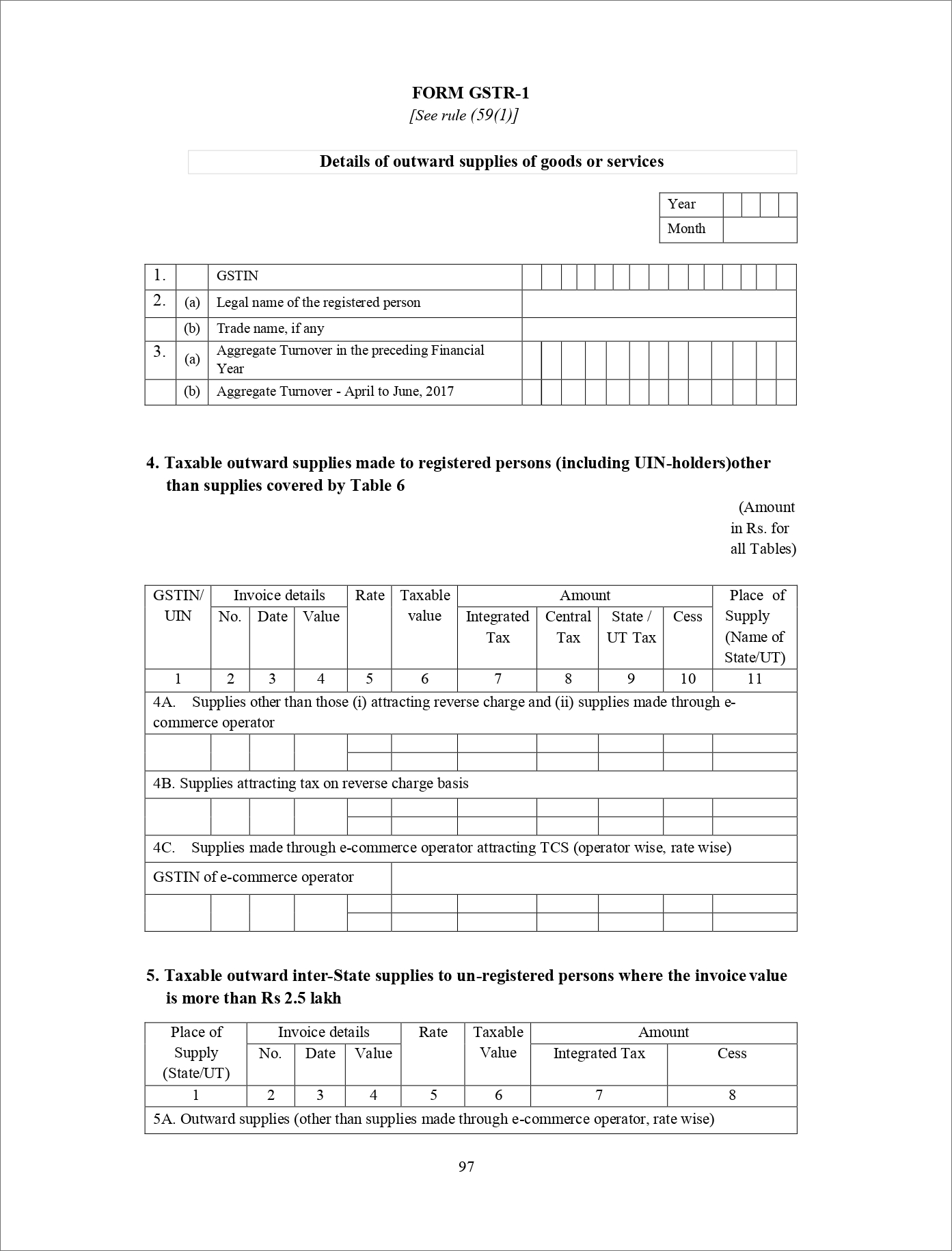

GSTR-1: Details of outward supplies (sales)

-

GSTR-3B: Summary return of inward and outward supplies

-

GSTR-4: Return for composition scheme taxpayers

-

GSTR-9: Annual return

-

GSTR-9C: Reconciliation statement and certification

-

Other returns based on your business needs

Our GST Return Filing Services Include:

Who Needs to File GST Returns?