Revocation/Cancellation of GST Registration

Manage Your GST Registration with Confidence

Whether you're planning to cancel your GST registration or need help revoking a cancelled one, Account Wale is here to guide you through every step. Our team of GST experts ensures that the process is smooth, compliant, and hassle-free.

What is GST Registration Cancellation?

GST registration can be cancelled when a business is no longer liable to pay GST or has discontinued, merged, transferred, or changed the nature of operations. It can be initiated voluntarily by the taxpayer or by the GST officer due to non-compliance or inactivity.

Common Reasons for Cancellation

-

Business discontinued or closed

-

Change in business constitution (e.g., merger, sale)

-

Voluntary cancellation for turnover below threshold

-

Non-filing of GST returns for a continuous period

-

Fraudulent registration or misuse of GST

What is Revocation of Cancellation?

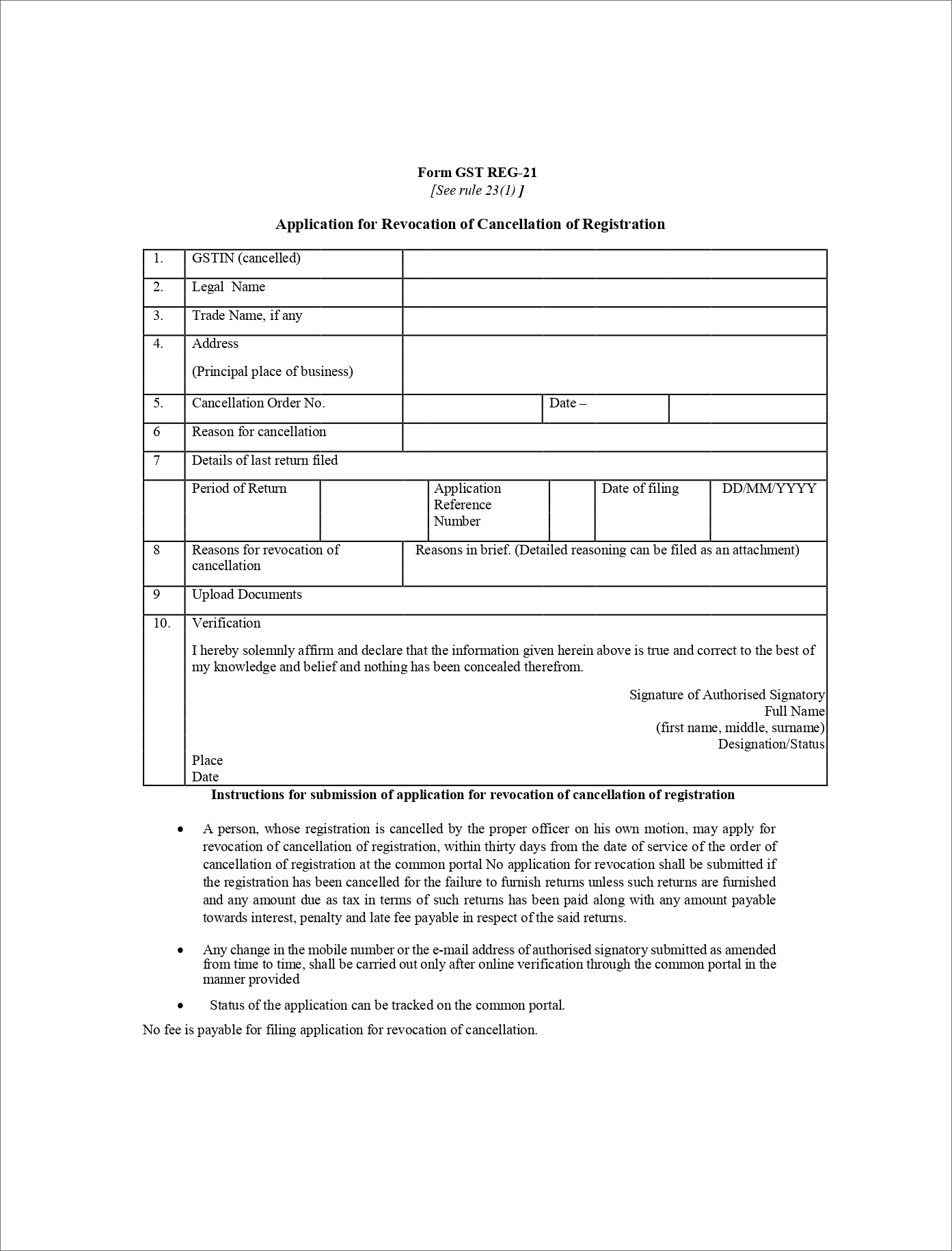

If your GST registration was cancelled by the GST department, and you wish to continue operating, you can apply for revocation within 30 days from the date of cancellation order. This is a one-time chance to restore your GSTIN and business operations legally.

Our Services Include: