GST LUT Filing

Export Without Paying Tax – File Your LUT with Ease

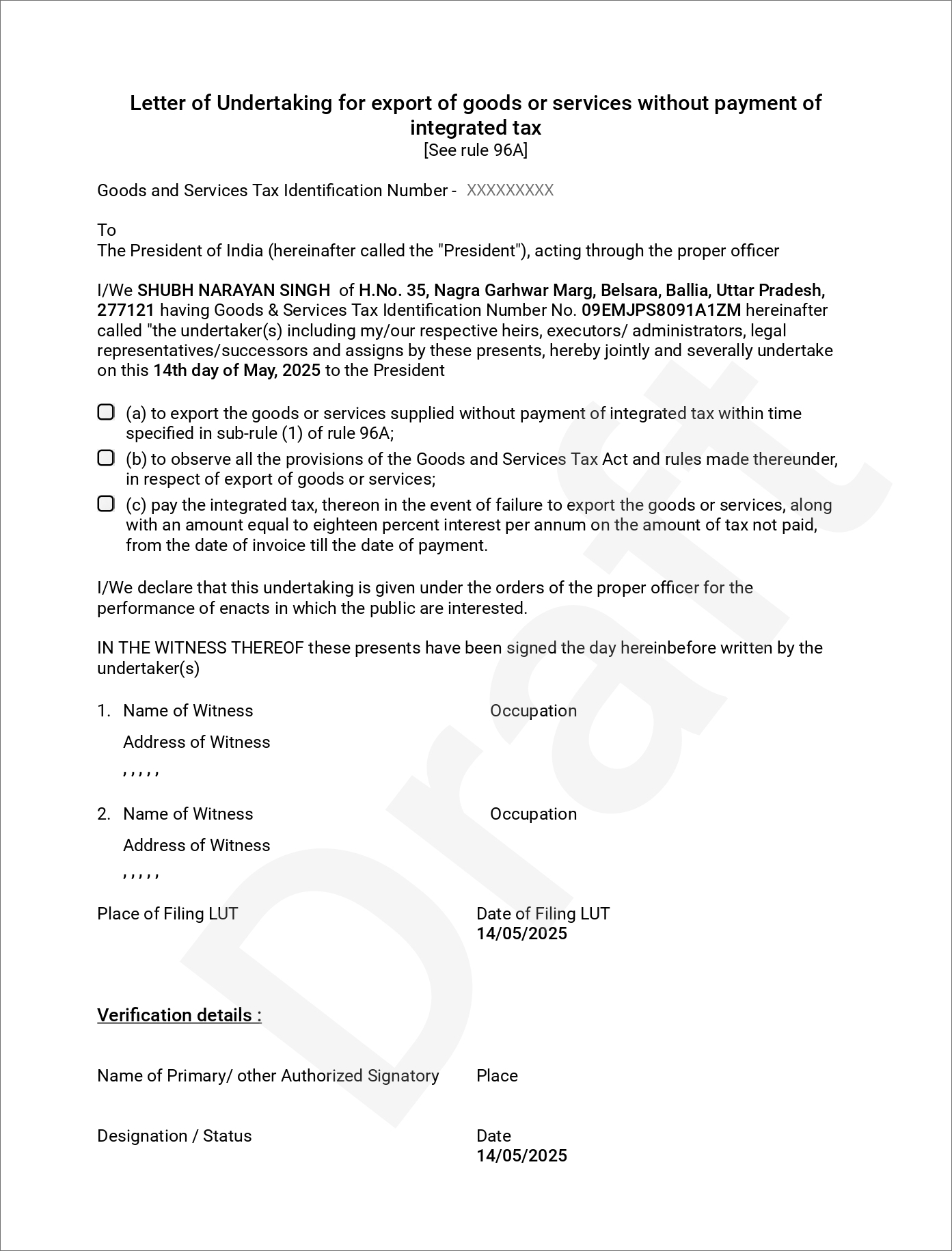

If you're an exporter of goods or services, filing a Letter of Undertaking (LUT) under GST is essential to enjoy tax-free exports. At Account Wale, we provide fast, accurate, and end-to-end GST LUT filing services to ensure your export operations remain smooth and compliant.

What is LUT in GST?

A Letter of Undertaking (LUT) is a document that allows exporters to supply goods or services without paying Integrated GST (IGST). It must be filed online with the GST portal and is valid for one financial year.

Who Should File an LUT?

-

All registered taxpayers exporting goods or services

-

Exporters supplying to SEZs (Special Economic Zones)

-

Exporters wanting to claim exemption from IGST under GST

If you do not file an LUT, you are required to pay IGST on exports and later claim a refund—resulting in cash flow issues and delays.

Our GST LUT Filing Services Include:

Documents Required: